Affiliate marketing has become increasingly popular in recent years, offering individuals and businesses the opportunity to generate income by promoting products or services. However, it’s essential to understand the legal implications that come with this form of marketing. From disclosure requirements to intellectual property concerns, this article will explore the key legal considerations you need to be aware of when engaging in affiliate marketing. Whether you’re a seasoned affiliate marketer or just starting out, this comprehensive guide will help you navigate the legal landscape and ensure your marketing efforts are compliant and effective.

This image is property of www.termsfeed.com.

Overview of Affiliate Marketing

Affiliate marketing is a popular online marketing method that allows individuals and businesses to earn a commission by promoting and selling other people’s products or services. It is a performance-based marketing model, where affiliates receive compensation for driving traffic or generating sales through their marketing efforts.

Definition of affiliate marketing

Affiliate marketing involves three primary parties: the advertiser, the affiliate, and the consumer. The advertiser is the company or individual that owns the product or service being promoted. The affiliate is the marketer who promotes the product or service through various platforms. The consumer is the target audience who purchases the product or service through the affiliate’s marketing efforts.

Roles and parties involved in affiliate marketing

In affiliate marketing, the advertiser provides the product or service, the affiliate promotes it, and the consumer makes the purchase. The affiliate is essentially a middleman who connects the advertiser with the consumer. This model allows businesses to expand their reach and increase sales without investing heavily in traditional advertising methods.

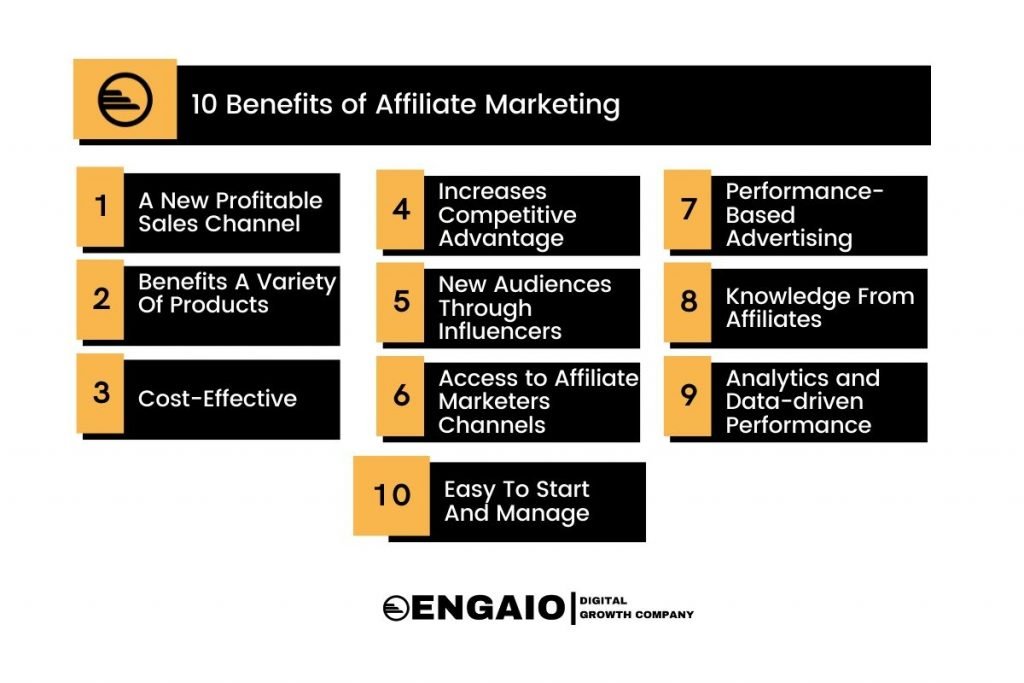

Benefits of affiliate marketing

Affiliate marketing offers numerous benefits for both the advertiser and the affiliate. For the advertiser, it allows them to tap into the affiliate’s existing audience and reach potential customers they might not have been able to access otherwise. They also benefit from the fact that they only pay the affiliate a commission when a sale or desired action is completed.

The affiliate, on the other hand, can earn passive income by promoting products or services they genuinely believe in. They can leverage their existing platforms, such as blogs, websites, or social media channels, to promote products and earn commissions. Affiliate marketing also offers flexibility, as affiliates can choose the products or services they want to promote.

Popular affiliate marketing platforms

There are several popular affiliate marketing platforms that connect advertisers with affiliates. These platforms provide a centralized marketplace where advertisers can list their products or services, and affiliates can choose the ones they want to promote. Some well-known affiliate marketing platforms include Amazon Associates, ShareASale, ClickBank, and Commission Junction.

Laws and Regulations

When engaging in affiliate marketing, it is essential to be aware of the legal considerations and regulations that govern this marketing method. Violating these laws can result in severe consequences and legal liabilities.

Disclosure requirements

One crucial aspect of affiliate marketing is disclosure. Affiliates must disclose their relationship with the advertiser to consumers, ensuring transparency and trust. Failure to disclose this information can be considered deceptive and may violate consumer protection regulations.

FTC guidelines for affiliate marketers

The Federal Trade Commission (FTC) in the United States has established guidelines that all affiliate marketers must follow. These guidelines aim to ensure that consumers are informed about any financial incentives the affiliate may receive for promoting a product or service.

EU General Data Protection Regulation (GDPR)

If you conduct affiliate marketing in the European Union (EU) or target EU residents, you must also comply with the General Data Protection Regulation (GDPR). The GDPR sets strict rules on how personal data should be processed, stored, and protected.

CAN-SPAM Act

The CAN-SPAM Act is a law that regulates commercial email communication. Affiliates engaged in email marketing must comply with this act, which requires clear and accurate subject lines, identification of emails as advertisements, and an opt-out mechanism for recipients.

Copyright and trademark laws

Affiliate marketers must also be mindful of copyright and trademark laws. Using copyrighted material without permission or infringing on trademarks can lead to legal disputes and financial penalties.

Tax implications

Affiliate marketing income is taxable, and affiliates are responsible for reporting their earnings to tax authorities. Understanding tax obligations and potential deductions is crucial for affiliate marketers to remain compliant with tax laws.

This image is property of www.privacypolicies.com.

Disclosure Requirements

Disclosure is a fundamental aspect of affiliate marketing. It provides transparency to consumers and ensures that they are aware of the financial incentives an affiliate may receive for promoting a product or service.

Importance of disclosure

Disclosure is vital because it fosters trust and transparency between the affiliate marketer and the consumer. When consumers are explicitly informed about the affiliate relationship, they can make informed decisions about whether to trust the recommendations and information provided by the affiliate.

FTC guidelines for disclosure

The FTC has specific guidelines for disclosure in affiliate marketing. According to these guidelines, disclosures must be clear, prominent, and easily understandable to consumers. They should be placed where they are likely to be seen and not hidden in small font or inconspicuous locations.

Types of disclosures

Disclosure can take various forms, depending on the marketing channels used by the affiliate. It can be a simple statement stating the affiliate’s relationship with the advertiser, a clear label on affiliate links or ads, or a specific disclosure statement within the content itself.

Placement of disclosure

The placement of the disclosure is crucial to ensure visibility and understanding. Disclosures should be placed before any affiliate links or recommendations, allowing consumers to see them before making any purchasing decisions. In digital platforms, disclosures should be visible without the need to scroll.

FTC Guidelines for Affiliate Marketers

The Federal Trade Commission (FTC) guidelines are essential for all affiliate marketers in the United States to follow. Complying with these guidelines not only helps affiliates stay within the bounds of the law but also builds trust with their audience.

Overview of FTC guidelines

The FTC guidelines require affiliates to disclose their relationship with advertisers, especially when there is a financial incentive involved. This disclosure must be clear, conspicuous, and placed in a location where consumers are likely to see it before making any purchasing decisions.

Required disclosures

Affiliates must clearly disclose any financial incentives they may receive for promoting products or services. This can be done through a statement indicating their affiliate status, labels on affiliate links, or a disclosure statement within the content.

Examples of compliant disclosures

Compliant disclosures can take various forms depending on the marketing channel used. For example, on a blog, the affiliate could include a statement at the beginning of a post that they may receive a commission on any resulting sales. On social media, they can use hashtags such as #ad, #sponsored, or #affiliate to indicate their relationship with the advertiser.

This image is property of www.privacypolicies.com.

EU General Data Protection Regulation (GDPR)

Affiliate marketers targeting European Union (EU) residents or operating within the EU must comply with the General Data Protection Regulation (GDPR). The GDPR sets strict guidelines for the collection, processing, and protection of personal data.

Key provisions of GDPR

The GDPR grants individuals control over their personal data. It establishes guidelines on consent, data subject rights, data breach notification, and the transfer of personal data outside the EU.

Consent requirements

Under the GDPR, affiliates must obtain explicit and informed consent from individuals before collecting or processing their personal data. Affiliates must clearly explain their data collection practices and provide opt-in mechanisms for consumers to consent to the use of their data.

Data subject rights

The GDPR provides individuals with various rights regarding their personal data. These rights include the right to access their data, the right to rectify any inaccuracies, the right to erasure (also known as the right to be forgotten), and the right to object to the processing of their data.

Data breach notification

In the event of a data breach that may result in a risk to individuals’ rights and freedoms, affiliates must notify the relevant data protection authorities and affected individuals within a specific timeframe. Failure to comply with data breach notification requirements can result in significant penalties.

Implications for affiliate marketers

Affiliate marketers must ensure that their data collection and processing practices align with the GDPR’s requirements. This may include implementing privacy policies, obtaining proper consent, and using secure data storage and processing systems.

CAN-SPAM Act

The CAN-SPAM Act is a law that regulates commercial email communication in the United States. It sets guidelines for the content of commercial emails, opt-out requirements, and penalties for non-compliance.

Overview of the CAN-SPAM Act

The CAN-SPAM Act applies to any commercial email communication that promotes products or services. It requires emails to be clearly identified as advertisements and includes provisions regarding opt-out mechanisms, content requirements, and sending behavior.

Required disclosures in email marketing

Affiliate marketers engaging in email marketing must comply with the CAN-SPAM Act’s disclosure requirements. This includes clearly identifying emails as advertisements, providing accurate header information, and disclosing the affiliate nature of the content or links within the email.

Opt-out requirements

The CAN-SPAM Act also mandates the inclusion of a visible and functional opt-out mechanism in commercial emails. Affiliates must provide consumers with a straightforward way to unsubscribe from their email lists and honor those requests promptly.

Penalties for non-compliance

Non-compliance with the CAN-SPAM Act can result in significant penalties. The FTC can impose fines of up to $43,280 per violation, and Internet Service Providers (ISPs) may also take legal action against violators, leading to reputation damage and email deliverability issues.

This image is property of engaiodigital.com.

Copyright and Trademark Laws

Copyright and trademark laws protect intellectual property rights, including logos, brand names, content, and creative works. Affiliate marketers must understand and comply with these laws to avoid copyright and trademark infringement.

Understanding copyright and trademark

Copyright protects original creative works, such as written content, images, videos, and software. Trademark, on the other hand, protects brand names, logos, slogans, or any distinctive sign that identifies a product or service.

Avoiding copyright and trademark infringement

Affiliate marketers must obtain the necessary rights or permissions to use copyrighted material. They should avoid using copyrighted content without permission, and instead, create original content or use licensed materials. When using trademarks, affiliates must also ensure that their use does not create confusion or dilute the trademark owner’s rights.

Fair use doctrine in affiliate marketing

The fair use doctrine allows limited use of copyrighted material for purposes such as criticism, commentary, news reporting, or education. While fair use can provide some flexibility for affiliates, it is essential to understand its limitations and apply it appropriately.

Consequences of copyright and trademark violations

Copyright and trademark violations can lead to legal disputes, cease and desist letters, and potentially significant financial penalties. Affiliates may face legal liabilities and damage to their reputation if they infringe on others’ intellectual property rights.

Tax Implications

Affiliate marketing income is subject to taxation, and affiliates are responsible for reporting their earnings to tax authorities. Understanding tax obligations and associated deductions is crucial for affiliate marketers to navigate their tax obligations effectively.

Reporting affiliate income

Affiliate income must be reported as taxable income on the appropriate tax forms. Affiliates should consult with a tax professional or seek guidance from tax authorities to ensure accurate reporting.

Understanding tax obligations for affiliate marketers

Tax obligations may vary depending on factors such as income level, jurisdiction, and legal structure. Affiliates need to familiarize themselves with tax regulations and requirements specific to their situation to avoid penalties or legal issues.

Legal structures for affiliate marketing businesses

Affiliate marketers may choose to operate their businesses as sole proprietors, partnerships, limited liability companies (LLCs), or corporations. Each legal structure has different tax implications and liabilities, so it is essential to select the most suitable structure based on individual circumstances.

This image is property of www.privacypolicies.com.

Intellectual Property

As an affiliate marketer, protecting intellectual property is crucial for maintaining trust and avoiding legal issues. Intellectual property includes trademarks, copyrights, patents, and trade secrets.

Protecting intellectual property

Affiliates should respect the intellectual property rights of others and avoid infringing on trademarks, copyrights, or patents. Using original content and obtaining necessary permissions or licenses are crucial steps in ensuring compliance.

Dealing with intellectual property disputes

In the event of an intellectual property dispute, affiliates should seek legal advice and respond promptly to any cease and desist letters or legal notices received. Engaging in good faith communication and taking appropriate action can help resolve disputes effectively.

Cease and desist letters

A cease and desist letter is a legal notice sent to individuals or businesses believed to be infringing on intellectual property rights. If an affiliate receives a cease and desist letter, it is crucial to review the claims, seek legal advice if necessary, and comply with the requested actions if warranted.

DMCA takedown notices

The Digital Millennium Copyright Act (DMCA) provides a process for copyright owners to request the removal of infringing content from websites or online platforms. Affiliates should be aware of the DMCA takedown notice process and respond promptly to any valid notices.

Liability and Legal Risks

Affiliate marketers face various legal risks, including false or misleading claims, defamation and libel, product liability issues, and risks when endorsing products.

Liability for false or misleading claims

Affiliate marketers must ensure that their marketing claims are accurate and not deceptive. Making false or misleading claims about products or services can lead to legal consequences, such as fines, penalties, or legal action by consumers or competitors.

Defamation and libel risks

Affiliates should be cautious about making negative statements or defamatory remarks about individuals, businesses, or competitors. Defamatory statements can result in legal claims for reputational damage and may lead to significant financial liabilities.

Product liability issues

Affiliates may face legal risks if the products or services they promote are defective or cause harm to consumers. Understanding the quality and safety of the products being marketed is crucial to avoid potential liabilities.

Legal risks in endorsing products

When endorsing products, affiliates should ensure that they have personal experience and knowledge of the product’s qualities and features. Misleading endorsements can result in legal claims and damage to the affiliate’s reputation.

In conclusion, affiliate marketing offers an excellent opportunity for individuals and businesses to generate income through promoting and selling products or services. However, it is essential to be aware of the laws and regulations surrounding affiliate marketing to avoid legal issues and maintain trust with consumers. By understanding disclosure requirements, complying with FTC guidelines, adhering to data protection regulations, respecting intellectual property rights, and considering tax implications, affiliate marketers can operate their businesses responsibly and effectively.